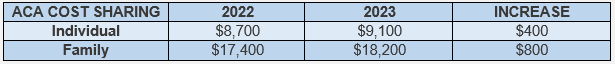

The U.S. Department of Health and Human Services (HHS) finalized an increase in the annual limit on cost-sharing for essential health benefits for non-grandfathered plans that apply to plan years beginning on or after January 1, 2023.

Note that plans that have a family out-of-pocket maximum that is higher than the ACA individual cost sharing limit must “embed” or apply the individual ACA cost sharing limit to each individual that is enrolled in the plan’s family coverage.

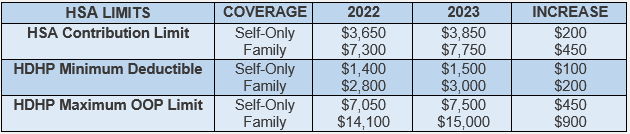

The IRS has also released the 2023 limits for HSAs and HDHPs. These limits vary based on whether an individual has self-only or family coverage under a HDHP.

Individuals 55 and over may contribute an extra $1,000 to their HSA.

Please be sure to review all your plans prior to finalizing 2023 benefit updates to be sure that your plan is in compliance with the dollar limits noted above. For questions, please contact your WebTPA Account Executive